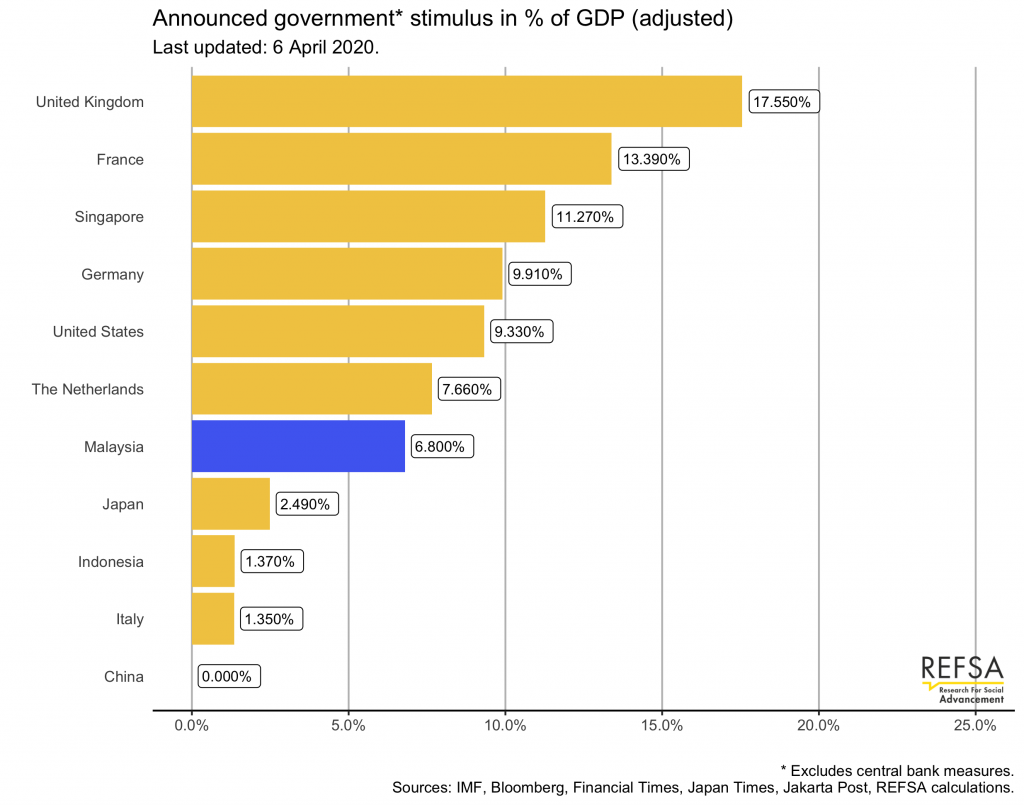

Chart A: Nominal GDP Chart showing total stimulus package announced by governments thus far.

The nominal amounts are taken directly from the government announcements or related news reports, and converted in USD in order to be able to compare. They do not attempt to “normalise” the different packages, so some of the amounts included here may not amount to the government taking on extra risk or extra liabilities.

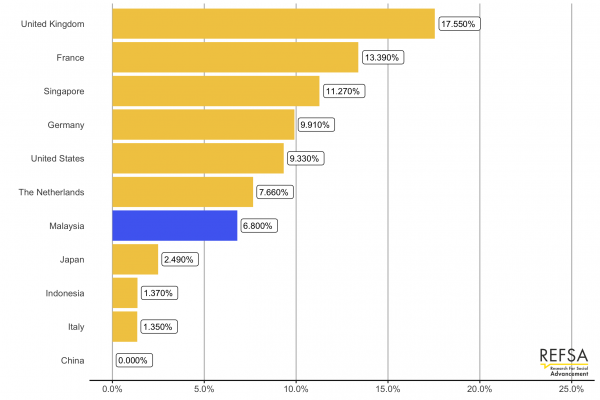

Chart B: Adjusted GDP Chart showing total fiscal measures within the stimulus package announced by governments thus far.

In order to try and gauge the effect of the stimulus packages on the economy, we attempt to normalise the packages across countries, by eliminating measures that do not form a liability (contingent or actual) for the government now or in the future.

Our reasoning is that a measure where the risk falls elsewhere than the government will not have as powerful an effect to stimulate the economy, due to agents’ expectations. For example, imposing a loan moratorium on banks without compensating the banks for the lost revenue may cause them to cut costs by reducing employment, which will exert downward pressure on the economy, due to the lost income.

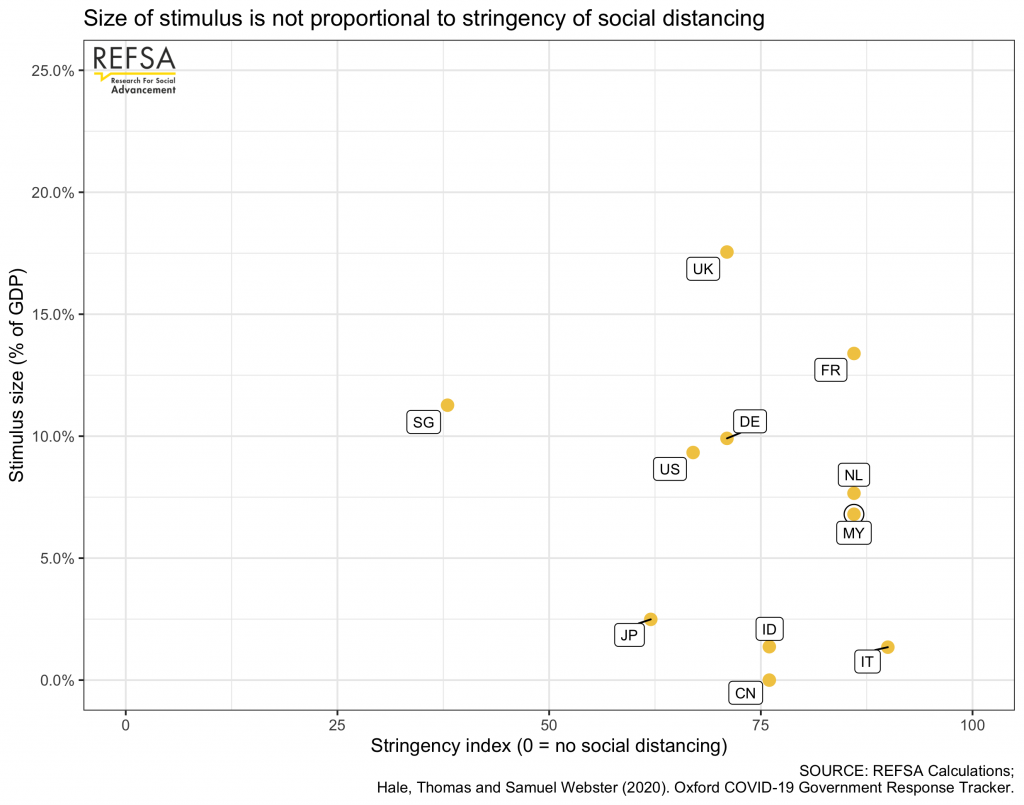

Chart C: Stimulus vs Stringency Plot Chart

Different countries have responded to the epidemic with different levels of social distancing. It stands to reason that the stricter the social distancing measures, the more the economy will suffer. Hence, stimulus packages should be greater in size in those countries with stricter measures.

The Blavatnik School of Government at Oxford University has launched a research project to measure the overall stringency of measures aimed at halting the spread of Covid-19. We combine the overall stringency index for the countries included in this analysis with the size of their overall stimulus package measured in percentage of GDP, in order to plot whether this relationship holds.

APR 7, 2020

On Monday, both Malaysia and Singapore announced further measures to stimulate their economies, in the wake of the Covid-19 pandemic and the far-reaching social distancing measures. We updated our stimulus trackers in response, presented with some notes below:

1) The additional RM 10bn the Malaysian government committed to support SME’s and micro-businesses is a welcome step and goes in the right direction. From Chart A it’s clear that, at face value, the Malaysian stimulus package is one of the largest. See Nominal GDP Chart.

2) However, when digging deeper, RM 100bn in the Malaysian package is borne by the banks, and RM 40bn is the rakyat’s money (EPF savings), so these have a smaller stimulus effect. Adjusting the numbers to take this into account, the relative size of the package changes significantly. See Chart B: Adjusted GDP Chart.

3) On the other hand, the extra SGD 5bn Singapore announced is all cash injected by the government. Singapore’s stimulus package is almost two thirds new cash, whereas Malaysia’s is only about a third.

4) In addition, we should also consider the strictness of the social distancing measures. The stricter, the greater the impact on the economy. Researchers at the Blavatnik School designed a “stringency index” to measure the strictness.

5) Mapping this stringency index on the stimulus sizes (in % of GDP) yields Chart C: Stimulus vs Stringency plot chart. Countries with stricter social distancing are further to the right, bigger stimulus packages are higher on the chart.

6) The plot chart does not yet include the stricter measures announced last week in Singapore, but the bulk of the stimulus was announced in February, so it confirms the outlier nature of Singapore’s stimulus.

7) On the other hand, Malaysia’s adjusted package ranks quite low compared to countries with similarly strict measures. Therefore we repeat our call for gov’t to increase the support to businesses further, from SME’s to self-employed. Better to do too much than too little at this point.